Before We Close Tax Gaps, We Have to Understand Them - CASE - Center for Social and Economic Research

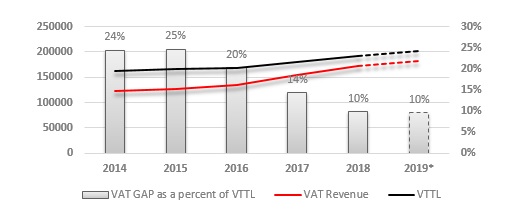

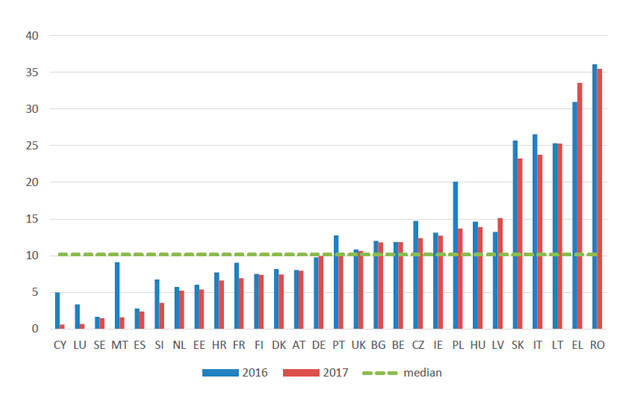

European Commission 🇪🇺 on Twitter: "EU countries lost €137 billion in Value-Added Tax (VAT) revenues in 2017. To achieve more meaningful progress and reduce the #VATGap, we will need to see a

European Commission 🇪🇺 on Twitter: "A new report shows that EU countries lost an estimated €140 billion in VAT revenues in 2018. While it's an improvement in recent years, 2020 forecast expects

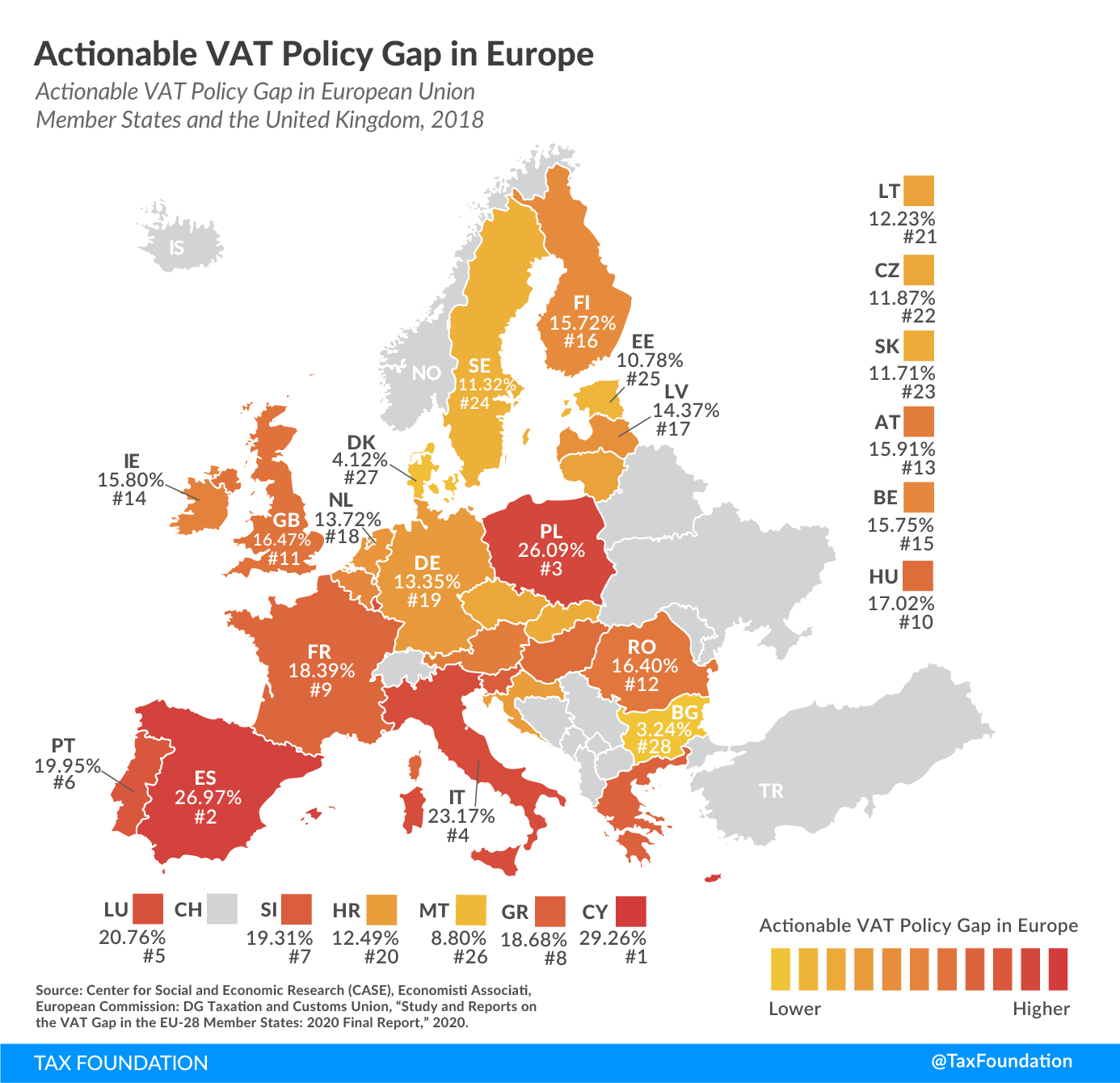

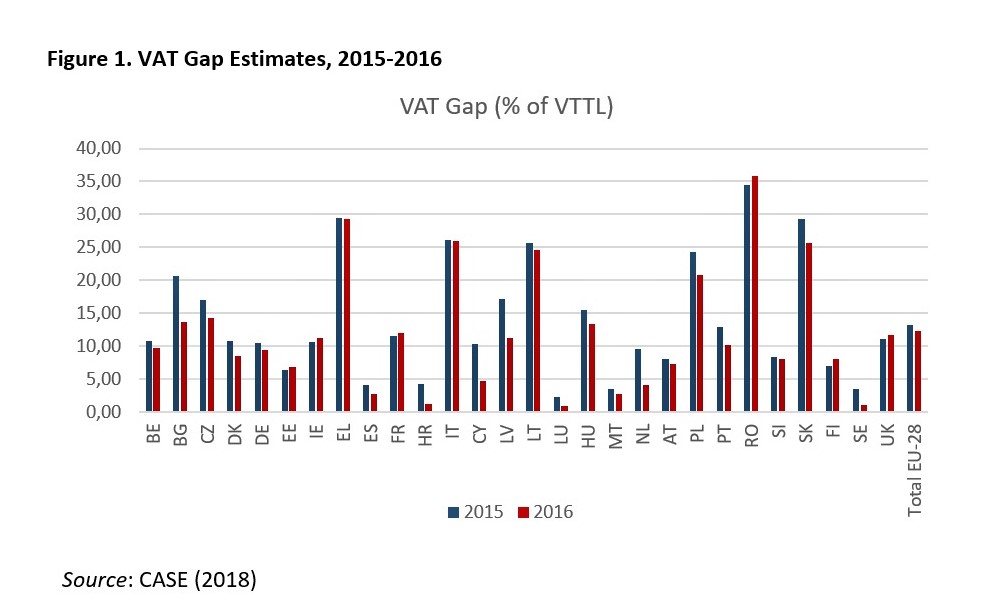

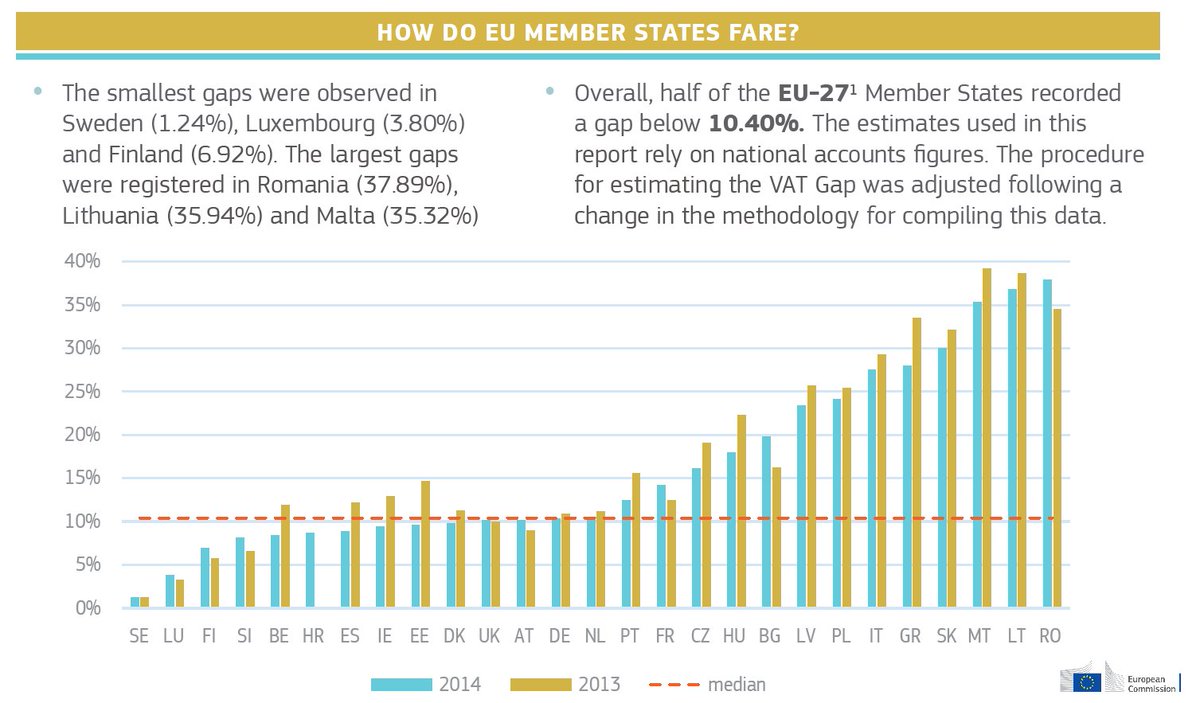

European Commission 🇪🇺 on Twitter: "What is the VAT Gap? | Main findings of the 2016 Report | Estimates per Member State → Q&A: https://t.co/IQBiB37f21… "